Introduction: SafeMoon educator Lord CatsRus tells us how SafeMoon V2 works and what it has to offer!

It was previously known that SafeMoon was operating under its V1 contract. Due to its limitations, the team was unable to advance and grow, preventing SafeMoon’s evolution. This is the reason for upgrading to the new V2 contact. This is what we are going to talk about in this article.

Important things to know

The launch of SafeMoon V2 involves an upgraded contract with a revised consolidation formula for the coin. Consolidation is a DeFi feature that the SafeMoon team likens to reversing stock splits, but with the added benefit of improving investor returns.

The V2 comes with a few upgrades on launch. Do note, this won’t be the end of them. The foundation that V2 brings allows the team to work at a more efficient level so that development can continue. They can look to adjust on the fly with a certain level of control and where required future contract updates can be made.

But why do we need it? As we run through the upgrades it will become more clear, but as a simple run down it provides control where needed for development along with adding an extra level of security. Finally it allows for better opportunities in things such as pairing with the likes of BTC.

Control

So how does the V2 contract provide control? Well, it’s known that if you look to take the new Burn Wallet address and view directly into the V2 contract, it would appear that the burn wallet isn’t receiving reflections and therefore not keeping its deflationary status.

How does SafeMoon burn then? The SafeMoon Team has created a tier-like system to provide control on how things are burned. Currently, there are 2 different tiers that are already operational, with more can look to be added as time goes on.

The Burn Wallet

So it is important to note the above in regards to the burn wallet. The burn wallet is technically not considered a holder, at least not through the direct rewards function that the rest of the holders would be under. And that is because it is brought into the tiered system.

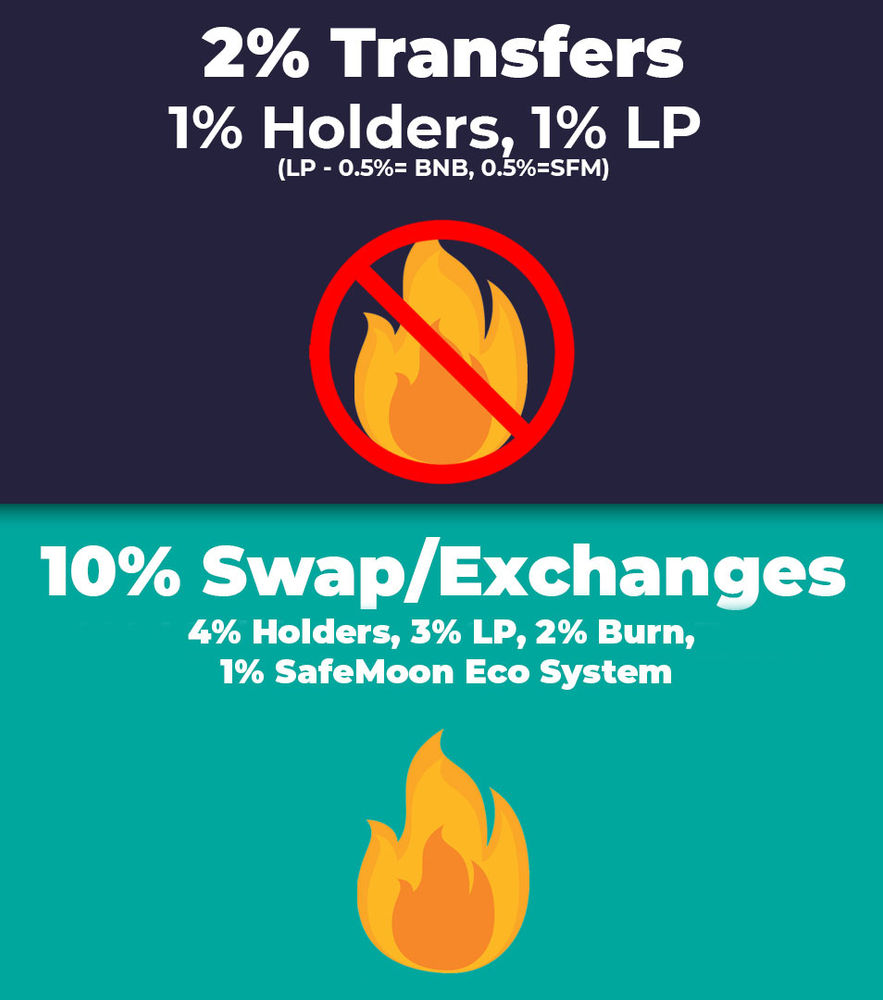

2% Transaction Fee

One of the tiered systems is the 2% transaction fee. This is a fee that is applied to you when you are looking to send SafeMoon from one wallet to another. This is now an incentive to the world of e-commerce and putting SafeMoon Fees at, similar if not better, rates than what Visa and MasterCard offer.

Lets take a look at the 2% structure;

2% Fee = 1% To all holders (NO BURN) = 1% to Liquidity Pool (0.5%= BNB, 0.5%=SFM)

As you can see that due to the small number of reflections given the team are allowing the tax from the 2% transfer tier to go back to all holder except the burn wallet. Giving holders a boost from the excluded burn wallet.

10% Buy/Sell Fee

The 10% Fee is a little different from how you remember it now has a static burn applied along with a static amount of reflections at 4%.

10% Fee = 4% To all holders = 4% to Liquidity Pool (2%= BNB, 2%=SFM) = 2% to Burn

It is important to know that they can make as many different tiers as they need. Over time as partnership happens they can make decisions to best suit the partnership and help grow SafeMoon.

Security

The Team is always looking to find ways to innovate in the security section of the Crypto and DeFi Space and the Blacklisting feature is something that is highly important especially with recent events surrounding BitMart. This feature does exactly what it says on the tin, it blocks those funds from being moved in time of emergency, essentially not allowing scammers or hackers to get away with the stolen funds.

This feature alone adds a massive deterrent to hackers/scammers as now they won’t get away with the funds. And this is just the start of what the team is looking to offer in regards to the security of your wallets/portfolio.

Conclusion

This is the first breakdown of the SafeMoon V2 improvements. While it contains a lot of what we know and loves about SafeMoon, it has a whole lot of room to grow that we didn’t once have.

Having the ability to create and adjust different rates based on the requirements is huge as they can indirectly control the burn and Liquidity generation and anything else that seems fitting to the tier system that they would like to create. As for now, we have 2 operating tiers with more to come.

If you have any questions on this, please look to reach out and we will be more than happy to explain it to you.

SafeMoon is the Evolution

Credit:

Disclaimer: The information provided on this page does not constitute investment advice, financial advice, trading advice, or any other sort of advice and it should not be treated as such. This content is the opinion of a third party and this site does not recommend that any specific cryptocurrency should be bought, sold, or held, or that any crypto investment should be made. The Crypto market is high-risk, with high-risk and unproven projects. Readers should do their own research and consult a professional financial advisor before making any investment decisions.